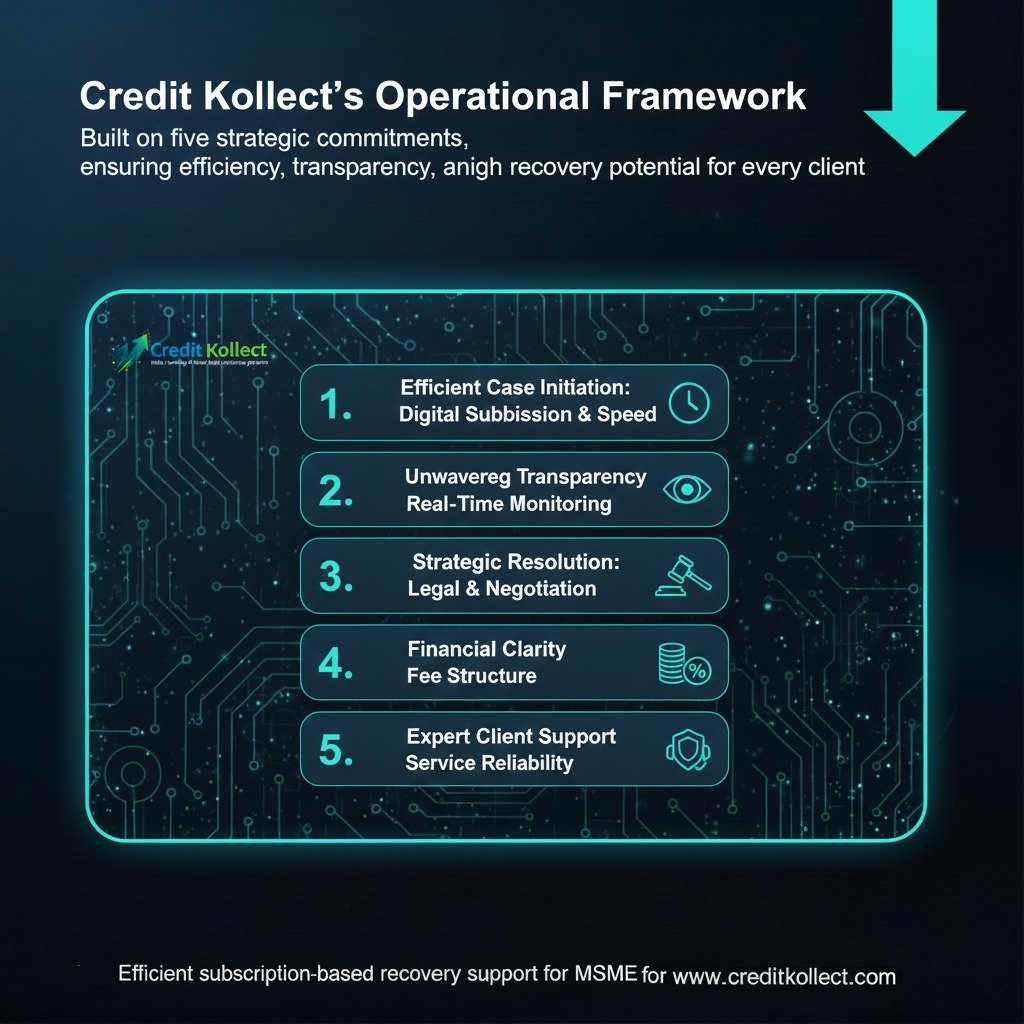

Our Core Credibility Pillars

Credit Kollect's operational framework is built on five strategic commitments, ensuring efficiency, transparency, and high recovery potential for every client

Efficient Case Initiation

Digital Submission & SpeedSeamless Digital On boarding: Submit all essential defaulter details and validated invoice information instantly via our secure online portal, eliminating cumbersome paperwork and accelerating the initiation process

Unwavering Transparency

Real-Time MonitoringComplete Case Visibility: Monitor the recovery lifecycle step-by-step with full, real-time transparency through your personalized Digital Dashboard , accessible anytime, from any location.

Strategic Resolution

Legal & NegotiationSmart Recovery Methodology: We prioritize professional negotiation to maximize settlement potential, utilizing escalation (including legal support) only as a strategic measure when absolutely necessary to ensure prompt resolution.

Financial Clarity

Fee StructureAbsolute Fee Transparency: We uphold a policy of complete financial clarity. Our fee structure is fully transparent, ensuring you know exactly what you are paying for, with zero hidden charges or unexpected deductions.

Absolute Fee Transparency:

Service ReliabilityDedicated Expert Support: Our specialist Customer Support team provides proactive assistance and continuous updates, ensuring all your queries are addressed promptly throughout the debt resolution cycle.

Register Your Business

How Credit Kollect Works

A simple, transparent, and efficient process designed to help you recover your pending payments quickly.

Core Reasons to Choose Credit Kollect

Empowering MSMEs with Fast, Transparent & Tech-Driven Recovery Solutions

AI-Powered Efficiency and Accuracy

AI-Powered Efficiency and Accuracy

Our AI-driven system is free from human error and delivers immediate, accurate solutions, saving you both time and money.

Complete Legal Protection

Complete Legal Protection

We go beyond standard services by offering expert legal assistance and full coverage to protect your interests completely. You get resolution without the legal complexity.

Comprehensive Follow – Up & Communications

Comprehensive Follow – Up & Communications

We ensure no communication gaps. With proactive SMS and WhatsApp follow-up services, we keep you updated at every step of the recovery process, demonstrating constant attention to your case.

Maximum Value On Investment

Maximum Value On Investment

Our solution is highly cost-effective, requiring only a nominal fee compared to the financial protection and value provided. Additional benefits (discounts/cashback) help immediately offset costs.

Digital Dashboard for Transparency

Digital Dashboard for Transparency

Our platform provides a Digital Dashboard for complete visibility. You get 24/7 access to track your entire recovery process, verification reports, and all case data.

Expeditious Case Submission

Expeditious Case Submission

Initiate your recovery process quickly and easily by submitting your defaulter's details and invoice information via our secure online portal, eliminating the need for lengthy manual paperwork.

Hear from those who reclaimed their peace and payments

Real success stories from MSMEs who recovered their dues with Credit Kollect

Why an AI – Powered

Platform is Essential

0

Till now successful recovered amount & counting!

Satisfied MSME Business Owners

5,000+

Resources that put you in control

Smart recovery tools designed for every business need

B2B Solutions –

Elevating Your Business with Credit Kollect

Unleashing the Power of B2B Solutions

Credit Kollect provides a specialized suite of B2B intelligence and risk management solutions engineered to redefine your organization's financial landscape. We enable sustained growth by mitigating credit risk through data-driven strategic tools.

- Dedicated Partnership: Personalized attention from a team of credit specialists who invest time to understand your unique operational requirements.

- Expert Delivery: Specialized knowledge and proven experience to assist with credit risk management, debt solutions, and effective dispute resolution.

- Comprehensive Network: Access to an extensive network of strategic partners and specialized vendors to address complex, multi-faceted credit challenges.

- Predictive Credit Risk Management (CRM): Leveraging advanced algorithms and proprietary analytics to proactively identify potential credit risks before they materialize.

- Continuous Portfolio Monitoring: Ongoing surveillance of customer payment behaviour and credit health indicators for timely intervention.

- Specialized Debt Solutions: Tailored resources and support to help businesses of all sizes stabilize working capital and overcome financial hurdles.

- Comprehensive Credit Assessment: Utilizing a multi-layered evaluation (including industry data and proprietary models) to set accurate credit limits and inform lending decisions.

- Access to Commercial Credit Reports (CCRs): Instant, 24/7 online access to validated, comprehensive credit intelligence on potential and existing clients.

- Integrated Settlement Framework: Seamless mechanisms to manage and document debt resolution, ensuring swift closure and minimizing administrative complexity.

- Absolute Transparency: Full visibility into the credit ecosystem, promoting market integrity and ensuring all transactional data is reliable and accurate.

MSME’s Solutions –

Empowering MSMEs with Credit Kollect

Unleashing the Potential: Benefits of MSME in India (Reinforced by Credit Kollect)

Credit Kollect is strategically dedicated to supporting the growth and financial stability of India's MSME sector by addressing their unique challenges related to credit, compliance, and capital recovery.

- Risk Mitigation: Tools to prevent revenue loss from defaults, ensuring capital remains free for innovation and job creation.

- Compliance Enablement: Simplified processes to ensure MSMEs can quickly secure the regulatory status needed to access government subsidies and benefits.

- Growth Facilitation: Solutions that stabilize cash flow, enabling MSMEs to expand operations without the constant threat of bad debt.

- Sector Performance Insights: Access to comprehensive data on the performance and collective credit behaviour of MSMEs across India.

- Credit Health Analysis: Rigorous analysis highlighting key trends, challenges, and growth opportunities within the MSME ecosystem.

- Stakeholder Intelligence: Essential information for policymakers and financial institutions to guide lending and resource allocation decisions aimed at the MSME sector.

- Seamless Digital On boarding User-friendly interface that eliminates tedious paperwork and navigating multiple government portals.

- Real-Time Validation Integrated checks to ensure accurate data entry, minimizing errors, rework, and application rejection delays.

- Automated Document Generation: System-generated forms and documents for efficient compliance, allowing entrepreneurs to focus on core business activities.

- Optimized Credit Access: Comprehensive credit assessment reports that objectively demonstrate an MSME’s creditworthiness, facilitating easier access to loans and financial support.

- Enhanced Credibility: Building a verifiable strong credit profile that attracts strategic investors, business partners, and lucrative commercial contracts.

- Accelerated Cash Flow: Tools designed to quickly recover outstanding payments, directly boosting working capital and improving financial resilience.

Business Debt Solutions –

Empowering Small Businesses

Credit Kollect provides strategic solutions

We provides strategic solutions to guide small and mid-sized businesses (SMEs) through the challenges of debt resolution and working capital recovery. Our platform empowers you to move beyond the question, "Udhaar Ko Kaise Settlement Karu?" (How do I settle credit dues?).

- Unilateral Control: You maintain sole control over the negotiation process and the final terms of the debt resolution.

- Structured Documentation: The platform provides a structured environment to document all communications and agreed-upon settlements, moving discussions from informal talks to verifiable records.

- Strategic Visibility: Access to the debtor's overall credit standing motivates them to engage seriously, influencing faster negotiation and resolution.

- Automated Communication: Utilize our integrated tools for automated payment reminders and multi-channel follow-ups (SMS, WhatsApp, email) to maintain consistent pressure professionally.

- Pre-emptive Nudging: Deploy communication tools before the due date to minimize the risk of a simple delay escalating into a default.

- Legal Deterrence: Leverage the platform's ability to formally report verified defaults, providing a strong incentive for the debtor to prioritize settling with your business to protect their market reputation.

- Digital Closure: Easily log the final settlement details on the platform once payment is received, ensuring a quick and clean closure of the dispute.

- Zero Intermediary Risk: Credit Kollect does not intervene in the financial exchange; the payment settlement remains strictly between you and the debtor, ensuring full control over funds.

- Financial Reintegration: Swift settlement documentation allows you to immediately reintegrate the recovered funds into your working capital, securing financial stability and future growth.

Business

Credit Bureau –

Empowering MSMEs With Verified Credit Intelligence

Credit Kollect empowers businesses with reliable and transparent credit insights.

Our Business Credit Bureau helps MSMEs, suppliers, distributors, and service providers assess the creditworthiness of their clients before extending credit. Instead of wondering, "Client ka payment risk kitna hai?" — our platform gives you verified, real-time credit intelligence to make confident financial decisions.

- Verified Credit Data: Access authentic payment history, outstanding dues, and default patterns of any business.

- Risk Profiling: Our system generates an easy-to-understand risk score based on multiple financial indicators.

- Transparency & Trust: Reports are collected from verified MSMEs, making them highly reliable for decision-making.

- Check Before You Deal: Verify a client’s market reputation and past payment behaviour before offering credit.

- Fraud Prevention: Identify businesses with repeated defaults or disputes across industries.

- Credit Limit Guidance: Get recommendations on how much credit you can safely extend.

- Safe Dealings: Make informed decisions and avoid high-risk customers.

- Faster Collections: Clients respond quicker when they know their credit profile is being monitored.

- Better Cash Flow: Reduce bad debts and ensure stable working capital for growth.

Need more help?

We’re here to guide you every step of the way

Chat with our CreditKollect Relationship Manager and get real-time help on fund recovery, dispute status, or MSME claims.

Available Mon–Sat: 10 AM – 7 PM.

support@creditkollect.com

Chat our Credit Kollect in panelled lawyers and get real-time help on fund recovery, dispute status, or MSME claims.

Available Mon–Sat: 10 AM – 7 PM.

legal@creditkollect.com

Have questions or ready to recover your funds? We’re here for you.

Speak with our recovery experts for personalized guidance.

admin@creditkollect.com

डिफॉल्टर की रेटिंग अब

अब आपके हाथ में!

Stop chasing, start recovering with our

AI-based platform.

₹7.34 Lakh Crore is overdue to MSMEs. Don't let yours be next.

Turn overdue debts into business growth.

Enter your email below.

We promise no spam, only value!